How did the Bitcoin

mining change: from CPU to cloud mining

Hey, geeks! Today we’d like to dedicate an article to the origins and

history of the most known and popular cryptocurrency — Bitcoin, also answering

the question “What is, in fact, Bitcoin?”

We hope you’ll enjoy our small

insight as we’ve made it as simple and informative as possible.

Everything started in 1983 when

David Chaum and Stefan Brands proposed the very first protocols of “electronic

cash”.

Several cryptocurrency concepts

were introduced later, and even some market mechanism models were estimated.

But only in 2008, the file with the description of the protocol and the working

principle of Bitcoin P2P network were published.

The person or even a group of

people behind it is still a mystery. The only thing we know about the creator

is a pseudonym, Satoshi Nakamoto. In 2009 Satoshi had finished the dashboard,

and the network was launched.

The first Bitcoin had been used for

purchase in 2010 when Laszlo Hanyecz bought two slices of pizza for 10 000

Bitcoins. Just to remind you, today 1 Bitcoin’s price is about $5300 and the

highest value can be over $5800 per 1 Bitcoin.

There are hundreds of other

cryptocurrencies: Litecoin, Ethereum, Ripple, and even Dogecoin or Fedoracoin.

But Bitcoin is the most widespread of all the cryptos. At the moment, thousands

of restaurants and shops worldwide accept Bitcoin as a payment method.

The gold fever

Mining (or so to say Bitcoin

production) is a process of solving a cryptographic task. The solution to the

task is a symbol sequence found by enumeration. That’s the reason why it is so

demanding for huge computation power.

The core of Bitcoin’s system safety

is also mining. Basically, miners group Bitcoin transactions into blocks which

are then hashed an unbelievable number of times to find one infrequent and

eligible hash value. When such a value is found, the block gets “mined” and is

put in a chain of previously mined blocks (the blockchain). The hashing itself

isn’t useful and is only needed to raise the difficulty of finding the

following appropriate hash value. This ensures that no one with unlimited

resources could take control over the whole system. For each block mined,

miners get a reward. Originally it was 50 Bitcoins per block, but to prevent

the uncontrolled emission of the currency the reward drops twice after every

210 000 blocks mined. Each new block appears in about 10 minutes — which means

a block can be mined in 9 as well as in 11 minutes. For the ease of

calculation, we’ll make it 10 minutes. On that basis, the total number of

Bitcoins should be no more than 21 million. About 55% of Bitcoins are already

mined, and it is estimated that 99% of them will be mined in 2032.

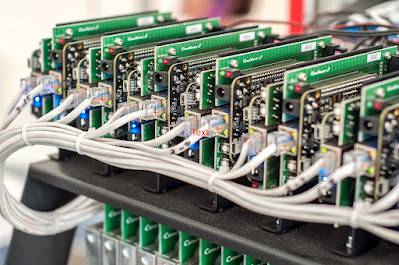

At the moment, there are four

generations of mining hardware (or miners) starting from simple CPU-miners and

ending with next-gen ASIC-miners. It doesn’t ultimately mean that you can’t

mine Bitcoins at home with your CPU — it just won’t be any profitable.

The first generation:

CPU-mining

Profit depends on your processor —

a top-class Core i7 would give you around 33 MH/s (mega hashes per second). All

calculations are processed on 512-bit blocks of data and contain a lot of

different operations. The result of each operation depends on the result of the

previous one.

The second generation: GPU-mining

The next generation of miners was based on processes taking place in graphics cards. Such miners contained bitcoin-protocol realisation in Java or Python and an enumeration algorithm in the form of an OpenCL file which should have been compiled accordingly to the ISA of a related GPU.

Miners used different tactics to

increase their profits. Some of them played with voltage: some increased it to

increase the productivity, others lowered it to save on electricity. Some tried

to modify GPU cores and code parameters to augment the flow.

Unlike CPU, which is always meant

to stay single, several GPUs can be connected to a motherboard forming a rig.

This allowed building first Bitcoin mining farms based on graphics processors.

Typical AMD GPUs demonstrate higher

productivity than nVidia’s once we compare GH/s to $ values. That’s why AMD

GPUs were and still are quite popular among miners.

The third generation:

FPGA-mining

FPGA-mining did not bloom for long

as It was quickly replaced by a new generation of hardware — ASIC. FPGA Spartan

XC6SLX150 based circuit boards allowed to raise productivity to 860 MH/s with

the frequency of 215 MHz, energy demand of 39W, and a price of $1060.

Proprietary hardware developed by Butterfly Labs (BFL) from Kansas, US showed

the similar productivity of 830 MH/s with $599 price tag. Their best solution

was based on the FPGA Altera showing 25,2 GH/s at the cost of $15K (650–750

MH/s per chip).

The main issue of FPGA mining, when

compared to GPU, was its cost. On average the cost of FPGA mining was 30%

higher. Besides that, GPU boards have greater potential for further reselling

once they’re not used for mining any longer.

The fourth generation:

ASIC-mining

The coming of ASIC was the end of

other types of mining. ASIC miners are significantly different in relation to

size to productivity and energy consumption. BFL was the first company to

appear on the market and was followed by ASICMINER and Avalon.

The fourth-generation miners were

expensive. As the popularity of cryptocurrencies grew, the interest in mining

also increased. Not everyone can afford a miner even in its minimal

procurement. High hardware prices forced people to find other solutions like

hardware downgrading or selling lighter versions of miners. But the price was

still quite too high, and users had to deal with all the problems, settings,

etc. Cloud mining quickly became an optimal solution opening the world of

Bitcoin mining to pretty much everyone.

Cloud mining

Bitcoin mining would become popular only once it was available to every interested person. Cloud mining was exactly that kind of thing. Our project allows users to rent part of our mining hardware power and start earning Bitcoins in just a few clicks. Everything you need is a desire and a few bucks for a start.

After registration, you only need

to choose the appropriate mining (be in Bitcoins, Litecoins or maybe Ethereum),

connect your wallet and start gaining your first Bitcoins.

The calculator will show your

estimated profit, and the graphs will allow you to follow the results in

different pools.

You can arrange the rented power

among the most preferred pools to maximise your profit. If you realize you need

more power, it is always possible to buy more.

Right now, Phanes Technology

operates on a whole range of different hardware, including all market’s top and

flagman models.

Ready to start yourself? We’re here

to help you! Let us know what you’d like to learn next.

#cloudmining #cloudminingwebsite

#cloudminingwebsites #crypto #cryptocurrency #cryptocurrencies #cryptotrading

#cryptonews #bitcoin #bitcoinmining #bitcoins

No comments:

Post a Comment